Auto Insurance

Teenagers and Adults

Teenagers and Adults

www.EducationDx.com

EducationDx

is a

FREE

Website

is a

FREE

Website

Does a Teen Driver Need

Auto Insurance

?

Here is a brief (general) description of each category: (Note: insurance company and state interpretation may vary. See individual state requirements/regulations and specific insurance company terms/definitions).

Bodily Injury Liability

This applies to injuries that you, the designated driver or policyholder, cause to someone else. You and family members listed on the policy are covered when driving someone else's car with their permission.

This pays for the treatment of injuries to the driver and passengers of the policyholder's car. PIP can cover medical payments, lost wages and the cost of replacing services normally performed by someone injured in an auto accident. According to the Insurance Information Institute the following states require PIP coverage:

Arkansas, Delaware, Florida, Hawaii, Kansas, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, Utah

This pays for damage you or someone driving the car with your permission may cause to someone else's property. Usually, this means damage to someone else's car, but it may includes damage to utility poles, fences, buildings or other structures damaged by your car.

This pays for damage to your car resulting from a collision with another car, object or as a result of rolling over. It may cover damage caused by potholes on highways. Usually, collision coverage is offered with a deductible of $250 to $1,000, and of course, the higher your deductible, the lower your premium.

Even if you are at fault in an accident, your collision coverage will reimburse you for the costs of repairing your car, minus the deductible. If you are not at fault, your insurance company may try to recover the amount they paid you from the other driver's insurance company. If they are successful, you may be reimbursed for the deductible.

This reimburses you for loss due to theft or damage caused by something other than a collision with another car or object, such as fire, falling objects, explosion, earthquake, windstorm, hail, flood, vandalism, riot, or contact with animals, e.g., birds, deer.

Usually, comprehensive insurance is offered with a $100 to $300 deductible, although you may want to choose a higher deductible as a way of lowering your premium. Comprehensive insurance will also reimburse you if your windshield is cracked or shattered. Some companies offer glass coverage with or without a deductible.

Some companies will offer a "glass repair" at no cost (if possible, like with a very small crack) rather than replacing the entire windshield. With this repair, the small crack is still visible, but stops the crack from enlarging, and it saves the cost of a replacement and/or deductible.

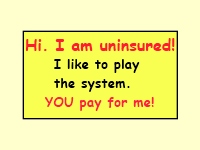

This next one might help answer the question, "Do I need auto insurance?"

This will reimburse you, a member of your family, or a designated driver if an uninsured or hit-and-run driver hits one of you. Underinsured motorist coverage comes into play when an at-fault driver has insufficient insurance to pay for your total loss. Also, this coverage will protect you if you are hit as a pedestrian.

***

Some Final Tips!

Play it safe! Read your insurance policy and ask your agent to show you in writing (point out the section) what your insurance actually covers. Ask questions before you might need to use the policy. Insurance documents are loaded with legalize phrases and meanings. Agents are used to newbies asking questions, but you need to ask it again if you don't understand.

Bodily Injury Liability

This applies to injuries that you, the designated driver or policyholder, cause to someone else. You and family members listed on the policy are covered when driving someone else's car with their permission.Medical Payments or Personal Injury Protection (PIP)

This pays for the treatment of injuries to the driver and passengers of the policyholder's car. PIP can cover medical payments, lost wages and the cost of replacing services normally performed by someone injured in an auto accident. According to the Insurance Information Institute the following states require PIP coverage:

Arkansas, Delaware, Florida, Hawaii, Kansas, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, Utah

Property Damage Liability

This pays for damage you or someone driving the car with your permission may cause to someone else's property. Usually, this means damage to someone else's car, but it may includes damage to utility poles, fences, buildings or other structures damaged by your car.

Collision

This pays for damage to your car resulting from a collision with another car, object or as a result of rolling over. It may cover damage caused by potholes on highways. Usually, collision coverage is offered with a deductible of $250 to $1,000, and of course, the higher your deductible, the lower your premium.

Even if you are at fault in an accident, your collision coverage will reimburse you for the costs of repairing your car, minus the deductible. If you are not at fault, your insurance company may try to recover the amount they paid you from the other driver's insurance company. If they are successful, you may be reimbursed for the deductible.

Comprehensive

This reimburses you for loss due to theft or damage caused by something other than a collision with another car or object, such as fire, falling objects, explosion, earthquake, windstorm, hail, flood, vandalism, riot, or contact with animals, e.g., birds, deer.

Usually, comprehensive insurance is offered with a $100 to $300 deductible, although you may want to choose a higher deductible as a way of lowering your premium. Comprehensive insurance will also reimburse you if your windshield is cracked or shattered. Some companies offer glass coverage with or without a deductible.

Some companies will offer a "glass repair" at no cost (if possible, like with a very small crack) rather than replacing the entire windshield. With this repair, the small crack is still visible, but stops the crack from enlarging, and it saves the cost of a replacement and/or deductible.

This next one might help answer the question, "Do I need auto insurance?"

Uninsured and Underinsured Motorist Coverage

This will reimburse you, a member of your family, or a designated driver if an uninsured or hit-and-run driver hits one of you. Underinsured motorist coverage comes into play when an at-fault driver has insufficient insurance to pay for your total loss. Also, this coverage will protect you if you are hit as a pedestrian.

***

Some Final Tips!

Play it safe! Read your insurance policy and ask your agent to show you in writing (point out the section) what your insurance actually covers. Ask questions before you might need to use the policy. Insurance documents are loaded with legalize phrases and meanings. Agents are used to newbies asking questions, but you need to ask it again if you don't understand.

EducationDx

©2016, 2023

©2016, 2023

Other pages of interest:

This is not a sales site.

Compare prices to get the best insurance rates

Compare prices to get the best insurance rates

You can't turn on the TV and not be exposed to an auto insurance commercial. There is much competition among large insurance companies as well as small ones. It is best to shop around for auto insurance to compare rates, coverage, and service. Some companies will give you a discount if you have your auto and house insured with them. Some give a discount if you complete a driver safety course.

"Do you really need auto insurance, if so, what type do you need to purchase?" "I'm a teenager, don't own anything worth suing over, do I still need car insurance?" These are a couple common questions raised in driver education classes. The general answer is YES, you do need insurance. But it is more complicated than that.

In Rhode Island the following levels of insurance are the minimal amounts of coverage required before operating a vehicle:

-single person bodily injury coverage at $25,000 per accident

-multiple person bodily injury coverage at $50,000 per accident to cover all persons involved

-property damage coverage at $25,000 to repair or replace damage done to the property of others in an accident

-single person bodily injury coverage at $25,000 per accident

-multiple person bodily injury coverage at $50,000 per accident to cover all persons involved

-property damage coverage at $25,000 to repair or replace damage done to the property of others in an accident

Basic auto insurance

consists of: bodily injury liability; property damage liability; medical payments or personal injury protection (PIP); collision; comprehensive; uninsured/underinsured motorists coverage (UM/UIM). Also, other services are available like roadside assistance, rental reimbursement, gap coverage.

For more information about these and other states, try using one of the many insurance requirement search tools after reading this article. There are other types of auto insurance besides the mandatory liability insurance mentioned above. You can select any additional coverage that you want according to your individual needs and your budget.

Tip: Make your own chart so that you can compare prices of different insurance companies with the same coverage and service. The insurance company "comparison chart" should reflect identical coverage when comparing competitor rates, and your chart should confirm that everyone is comparing "apples to apples and oranges to oranges."

Tip: Make your own chart so that you can compare prices of different insurance companies with the same coverage and service. The insurance company "comparison chart" should reflect identical coverage when comparing competitor rates, and your chart should confirm that everyone is comparing "apples to apples and oranges to oranges."

Each state has its own requirements and regulations for auto insurance. For example, in Pennsylvania, you are required to carry liability insurance at the following minimum levels in order to operate a vehicle on state roads and highways:

-$15,000 for death or injury to any single person involved in an accident

-$30,000 for death or injury to multiple persons involved in any accident

-$5,000 for damages caused to the property of the state or another person

-$15,000 for death or injury to any single person involved in an accident

-$30,000 for death or injury to multiple persons involved in any accident

-$5,000 for damages caused to the property of the state or another person

Whereas, the party of the first part...as it pertains...

specifically to Article B, Section IV...in the nofault provision... Huh?

specifically to Article B, Section IV...in the nofault provision... Huh?

Auto Insurance

Teenagers and Adults

Teenagers and Adults

This is a FREE information site!

www.EducationDx.com

Note: Larger computer screens will show larger materials!

Does a Teen Driver

Need Auto Insurance?

Need Auto Insurance?

You can't turn on the TV and not be exposed to an auto insurance commercial. There is much competition among large insurance companies as well as small ones. It is best to shop around for auto insurance to compare rates, coverage, and service. Some companies will give you a discount if you have your auto and house insured with them. Some give a discount if you complete a driver safety course.

"Do you really need auto insurance, if so, what type do you need to purchase?" "I'm a teenager, don't own anything worth suing over, do I still need car insurance?" These are a couple common questions raised in driver education classes. The general answer is YES, you do need insurance. But it is more complicated than that.

In Rhode Island the following levels of insurance are the minimal amounts of coverage required before operating a vehicle:

-single person bodily injury coverage at $25,000 per accident

-multiple person bodily injury coverage at $50,000 per accident to cover all persons involved

-property damage coverage at $25,000 to repair or replace damage done to the property of others in an accident

-single person bodily injury coverage at $25,000 per accident

-multiple person bodily injury coverage at $50,000 per accident to cover all persons involved

-property damage coverage at $25,000 to repair or replace damage done to the property of others in an accident

For more information about these and other states, try using one of the many insurance requirement search tools after reading this article. There are other types of auto insurance besides the mandatory liability insurance mentioned above. You can select any additional coverage that you want according to your individual needs and your budget.

Tip: Make your own chart so that you can compare prices of different insurance companies with the same coverage and service. The insurance company "comparison chart" should reflect identical coverage when comparing competitor rates, and your chart should confirm that everyone is comparing "apples to apples and oranges to oranges."

Tip: Make your own chart so that you can compare prices of different insurance companies with the same coverage and service. The insurance company "comparison chart" should reflect identical coverage when comparing competitor rates, and your chart should confirm that everyone is comparing "apples to apples and oranges to oranges."

Each state has its own requirements and regulations for auto insurance. For example, in Pennsylvania, you are required to carry liability insurance at the following minimum levels in order to operate a vehicle on state roads and highways:

-$15,000 for death or injury to any single person involved in an accident

-$30,000 for death or injury to multiple persons involved in any accident

-$5,000 for damages caused to the property of the state or another person

-$15,000 for death or injury to any single person involved in an accident

-$30,000 for death or injury to multiple persons involved in any accident

-$5,000 for damages caused to the property of the state or another person

Basic auto insurance consists of: bodily injury liability; property damage liability; medical payments or personal injury protection (PIP); collision; comprehensive; uninsured/underinsured motorists coverage (UM/UIM). Also, other services are available like roadside assistance, rental reimbursement, gap coverage.

Whereas, the party of the first part...as it pertains...

specifically to Article B, Section IV...in the nofault provision... Huh?

specifically to Article B, Section IV...in the nofault provision... Huh?

Here is a brief (general) description of each category: (Note: insurance company and state interpretation may vary. See individual state requirements/regulations and specific insurance company terms/definitions).

Bodily Injury Liability

This applies to injuries that you, the designated driver or policyholder, cause to someone else. You and family members listed on the policy are covered when driving someone else's car with their permission.

Medical Payments or Personal Injury Protection (PIP)

This pays for the treatment of injuries to the driver and passengers of the policyholder's car. PIP can cover medical payments, lost wages and the cost of replacing services normally performed by someone injured in an auto accident. According to the Insurance Information Institute the following states require PIP coverage:

Arkansas, Delaware, Florida, Hawaii, Kansas, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, Utah

Property Damage Liability

This pays for damage you or someone driving the car with your permission may cause to someone else's property. Usually, this means damage to someone else's car, but it may includes damage to utility poles, fences, buildings or other structures damaged by your car.

Collision

This pays for damage to your car resulting from a collision with another car, object or as a result of rolling over. It may cover damage caused by potholes on highways. Usually, collision coverage is offered with a deductible of $250 to $1,000, and of course, the higher your deductible, the lower your premium.

Even if you are at fault in an accident, your collision coverage will reimburse you for the costs of repairing your car, minus the deductible. If you are not at fault, your insurance company may try to recover the amount they paid you from the other driver's insurance company. If they are successful, you may be reimbursed for the deductible.

Comprehensive

This reimburses you for loss due to theft or damage caused by something other than a collision with another car or object, such as fire, falling objects, explosion, earthquake, windstorm, hail, flood, vandalism, riot, or contact with animals, e.g., birds, deer.

Usually, comprehensive insurance is offered with a $100 to $300 deductible, although you may want to choose a higher deductible as a way of lowering your premium. Comprehensive insurance will also reimburse you if your windshield is cracked or shattered. Some companies offer glass coverage with or without a deductible.

Some companies will offer a "glass repair" at no cost (if possible, like with a very small crack) rather than replacing the entire windshield. With this repair, the small crack is still visible, but stops the crack from enlarging, and it saves the cost of a replacement and/or deductible.

This next one might help answer the question, "Do I need auto insurance?"

Uninsured and Underinsured Motorist Coverage

This will reimburse you, a member of your family, or a designated driver if an uninsured or hit-and-run driver hits one of you. Underinsured motorist coverage comes into play when an at-fault driver has insufficient insurance to pay for your total loss. Also, this coverage will protect you if you are hit as a pedestrian.

***

Some Final Tips!

Play it safe! Read your insurance policy and ask your agent to show you in writing (point out the section) what your insurance actually covers. Ask questions before you might need to use the policy. Insurance documents are loaded with legalize phrases and meanings. Agents are used to newbies asking questions, but you need to ask it again if you don't understand.

Bodily Injury Liability

Medical Payments or Personal Injury Protection (PIP)

This pays for the treatment of injuries to the driver and passengers of the policyholder's car. PIP can cover medical payments, lost wages and the cost of replacing services normally performed by someone injured in an auto accident. According to the Insurance Information Institute the following states require PIP coverage:

Arkansas, Delaware, Florida, Hawaii, Kansas, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, Utah

Property Damage Liability

This pays for damage you or someone driving the car with your permission may cause to someone else's property. Usually, this means damage to someone else's car, but it may includes damage to utility poles, fences, buildings or other structures damaged by your car.

Collision

This pays for damage to your car resulting from a collision with another car, object or as a result of rolling over. It may cover damage caused by potholes on highways. Usually, collision coverage is offered with a deductible of $250 to $1,000, and of course, the higher your deductible, the lower your premium.

Even if you are at fault in an accident, your collision coverage will reimburse you for the costs of repairing your car, minus the deductible. If you are not at fault, your insurance company may try to recover the amount they paid you from the other driver's insurance company. If they are successful, you may be reimbursed for the deductible.

Comprehensive

This reimburses you for loss due to theft or damage caused by something other than a collision with another car or object, such as fire, falling objects, explosion, earthquake, windstorm, hail, flood, vandalism, riot, or contact with animals, e.g., birds, deer.

Usually, comprehensive insurance is offered with a $100 to $300 deductible, although you may want to choose a higher deductible as a way of lowering your premium. Comprehensive insurance will also reimburse you if your windshield is cracked or shattered. Some companies offer glass coverage with or without a deductible.

Some companies will offer a "glass repair" at no cost (if possible, like with a very small crack) rather than replacing the entire windshield. With this repair, the small crack is still visible, but stops the crack from enlarging, and it saves the cost of a replacement and/or deductible.

This next one might help answer the question, "Do I need auto insurance?"

Uninsured and Underinsured Motorist Coverage

This will reimburse you, a member of your family, or a designated driver if an uninsured or hit-and-run driver hits one of you. Underinsured motorist coverage comes into play when an at-fault driver has insufficient insurance to pay for your total loss. Also, this coverage will protect you if you are hit as a pedestrian.

***

Some Final Tips!

Play it safe! Read your insurance policy and ask your agent to show you in writing (point out the section) what your insurance actually covers. Ask questions before you might need to use the policy. Insurance documents are loaded with legalize phrases and meanings. Agents are used to newbies asking questions, but you need to ask it again if you don't understand.

Amazon Links

Disclosure:

Some links on this website are associate links and are used to help illustrate what an item looks like, and you can decide if you want to just look or purchase the item. "As an Amazon Associate, I earn from qualifying purchases." We receive a small commission (that helps support this website) if you actually purchase from this company, but the price to you remains the same.

You can hover over any link to see if it is an Amazon link, if this matters, or a link to a page on this website or to a reference page, e.g., Smithsonian Institution, bookmark on this website, etc.

Some links on this website are associate links and are used to help illustrate what an item looks like, and you can decide if you want to just look or purchase the item. "As an Amazon Associate, I earn from qualifying purchases." We receive a small commission (that helps support this website) if you actually purchase from this company, but the price to you remains the same.

You can hover over any link to see if it is an Amazon link, if this matters, or a link to a page on this website or to a reference page, e.g., Smithsonian Institution, bookmark on this website, etc.

Amazon Links

Disclosure:

Some links on this website are associate links and are used to help illustrate what an item looks like, and you can decide if you want to just look or purchase the item. "As an Amazon Associate, I earn from qualifying purchases." We receive a small commission (that helps support this website) if you actually purchase from this company, but the price to you remains the same.

You can hover over any link to see if it is an Amazon link, if this matters, or a link to a page on this website or to a reference page, e.g., Smithsonian Institution, bookmark on this website, etc.

Some links on this website are associate links and are used to help illustrate what an item looks like, and you can decide if you want to just look or purchase the item. "As an Amazon Associate, I earn from qualifying purchases." We receive a small commission (that helps support this website) if you actually purchase from this company, but the price to you remains the same.

You can hover over any link to see if it is an Amazon link, if this matters, or a link to a page on this website or to a reference page, e.g., Smithsonian Institution, bookmark on this website, etc.

EducationDx

©2016, 2023

©2016, 2023

Note:

Check for current requirements in these examples.

States may make changes in required coverage and limits, etc.

Check for current requirements in these examples.

States may make changes in required coverage and limits, etc.

Note:

Check for current requirements in these examples.

States may make changes in required coverage and limits, etc.

Check for current requirements in these examples.

States may make changes in required coverage and limits, etc.